Hey there,

Today’s post is on how to ace your FP&A interview by knowing 3 essential financial metrics.

This post will help you understand the 3 most important ones:

- Revenue

- Gross profit and margin

- Free cash flow

Companies that keep a close watch on these metrics thrive.

And FP&A job candidates that know these metrics get hired. 👍

Let’s get started.

Today’s job market is COMPETITIVE

Let’s face it, the job market is competitive nowadays.

It’s essential to stand out from other candidates during an FP&A interview.

But how do you stand out?

Every FP&A job is different.

Different hiring managers.

Different industries.

Different company lifecycle phases.

But, do you know what’s the same about each FP&A job?

Financial metrics. 💰

Knowing financial metrics will help you crush every FP&A job interview.

Why metrics matter in FP&A interviews

When driving a car, do you pay attention to your speedometer, fuel gauge, and GPS?

If your answer is NO, odds are you’re reading this post from the side of the road either broken down, pulled over by the police, or lost and looking for direction.

Not good.

Financial metrics to businesses are like car dashboard metrics to a driver.

Without them, you are driving blind and hoping for the best result.

Hope can only take a driver so far.

And hope can only take you (an FP&A job candidate) so far.

Don’t hope your interview goes well.

KNOW your interview WILL go well.

Be prepared. Be confident.

Let’s go.

Top 3 financial metrics to focus on

Keeping the important list of metrics short and sweet goes a long way.

Here’s why.

Let’s jump back into your car.

You’re the driver.

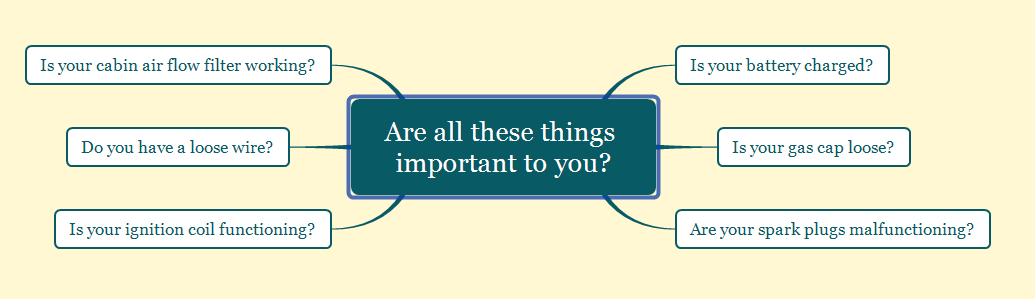

Are all the things listed below important to you?

- Is your battery charged?

- Is your gas cap loose?

- Are your spark plugs malfunctioning?

- Is your cabin air flow filter working?

- Do you have a loose wire?

- Is your ignition coil functioning?

Short answer is YES! All of these things are important.

But how are they measured and reported to the driver?

Through ONE metric — the check engine light. 🚨

If it’s not red or blinking, guess what?

Everything listed above plus more is functioning as it should.

You don’t need to be the smartest person in the room to understand that metric.

And that’s the point.

It’s the same with financial metrics.

They’re all important.

But 3 of them stand out as the most important.

Revenue

Are people buying what your company is selling?

Revenue answers this question.

It’s the total amount of money a company generates from its sales to customers.

Customers must be willing to pay a price in exchange for the product or service provided.

Without revenue, a company has little to no chance of surviving long-term.

Now do your homework on the company you are interviewing with.

You should be able to answer these questions:

- What types of customers are they targeting?

- What products and services do they offer?

- What does their pricing look like?

The above answers are even easier to get if you’re already a customer of theirs.

Now you can be dangerous when talking about revenue in the interview.

Let’s take it a step further.

Start asking your interviewer what their revenue goals are.

Some companies want to grow fast, say 50% or even 2x year over year.

Some want to grow more modestly, say 5-30% year over year.

Whatever they say, tell them you can help.

Want to be remembered as THE candidate that will help grow revenue on day 1?

Tell them you would do these 2 things to help them achieve their goals:

🔥Read: Help sales upsell existing customers using white space analysis.

🔥Read: Helps sales hit quarterly targets by proactively monitoring in real time.

Now you’re getting noticed.

Because you can clearly help the company and interviewer succeed.

Let’s keep building up your reputation as the #1 job candidate.

Gross profit and margin

It’s good to have customers purchasing your stuff.

It’s really good to have customers purchasing your stuff and making a profit while doing so.

Gross profit and margin is the first profitability measure.

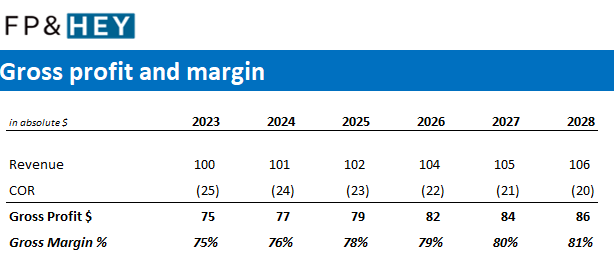

Here’s how to calculate both.

Gross profit = Revenue LESS Cost of Revenue

Gross Margin = Gross Profit DIVIDED BY Revenue

You already know what revenue is.

Cost of revenue includes things that go into creating or servicing what your company sells.

Here’s a high level gross profit and margin overview:

Here are some examples of COR/COGS:

- Server depreciation for SaaS products (aka Software as a Service)

- Customer support

- Raw materials

- Cost of labor (people)

- Equipment depreciation for physically produced products

Now ask your interviewer what their gross profit and margin targets are.

No matter what they say, guess what?

YOU can help them achieve those targets.

🔥Read: All companies need help with pricing, so let them you know a thing or two.

🔥Read: SaaS and Services companies need deal desks, so help them launch one.

Now you’re really getting noticed.

But there’s more you can do to make a lasting impression on your interviewer.

Let’s put a cherry on top of this interview sundae.

Free cash flow

Think about recent events.

Banks have liquidity issues.

Cash is very expensive to borrow.

Cash has, and always will be, the MOST important thing to a business.

Without it, no bills are paid.

So a company better have a plan to generate some cash in the future.

Free cash flow measures how much cash is generated by ongoing operations.

Free cash flow = Cash from operations LESS Capital expenditures

Cash from operations are the inflows from revenue.

It then gets reduced by outflows from expenses and purchases related to:

- Cost of revenue

- Sales (reps, commissions, travel)

- Marketing (marketers, advertising, brand, lead generation)

- Research and Development (engineers)

- Admin (human resources, finance, accounting, legal)

- Taxes (state, federal, country)

- Equipment and software purchases

Net of the above, if your free cash flow is positive then you are adding money to the bank account.

If it’s negative, you better have funding or a path to being positive in the future.

NOTE: Free cash flow does not include cash flows from financing activities (aka funding or paying off debt).

Ask your interviewer about their free cash flow today and what the long-range targets are.

And guess what?

Yes, one more time. Say it with me.

YOU can help.

What if they say funding will be needed in the future?

Tell them you got that covered too.

You just covered a lot of value adding ground.

And your interviewer can see the potential you bring. 💪

Conclusion: You will crush your next FP&A interview

You clearly articulated how financial metrics work.

By focusing on the vital few.

And expanding on them by explaining how to influence each.

You will help your future company hit their financial targets.

You will help your interviewer look good by hiring you.

And you will benefit from getting that job offer you deserve.

Prepare for every interview like it’s your last.

And be confident knowing you will put your best foot forward.

Now go get that job. 👊

How do you feel now? Ready to dominate the interview game?

Let us know by replying here or emailing us.

If there are specific topics you’d like us to cover as well, let us know!

Now go have fun making an impact on your company and your career!

Cheers,

Drew & Yarty

PS: This post is 100% human-made